Question: Presented below is an aging schedule for Harper Company. At December 31, 2013, the unadjusted balance in Allowance for Doubtful Accounts is a credit of

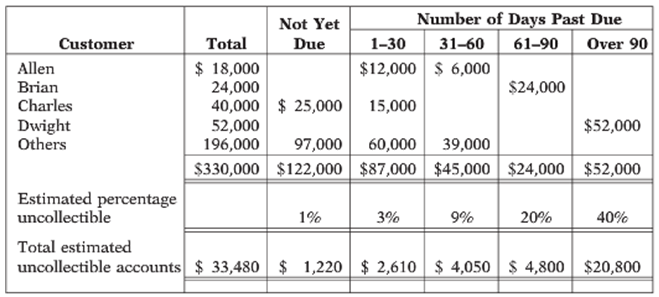

Presented below is an aging schedule for Harper Company.

At December 31, 2013, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $9,000.

Instructions

(a) Journalize and post the adjusting entry for bad debts at December 31, 2013. (Use T-accounts.)

(b) Journalize and post to the allowance account these 2014 events and transactions:

1. February 1, a $900 customer balance originating in 2013 is judged uncollectible.

2. July 1, a check for $900 is received from the customer whose account was writ-ten off as uncollectible on February 1.

(c) Journalize the adjusting entry for bad debts at December 31, 2014, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $2,800 and the aging schedule indicates that total estimated uncollectible accounts will be $30,600.

Number of Days Past Due Not Yet Over 90 Total Customer Due 1-30 31-60 6190 $12,000 $ 6,000 $ 18,000 24,000 40,000 $ 25,000 Allen Brian Charles Dwight Others $24,000 15,000 $52,000 52,000 196,000 60,000 39,000 $330,000 $122,000 $87,000 $45,000 $24,000 $52,000 97,000 Estimated percentage uncollectible 1% 3% 9% 20% 40% Total estimated uncollectible accounts $ 33,480 $ 1,220 $ 2,610 $ 4,050 $ 4,800 $20,800

Step by Step Solution

3.46 Rating (178 Votes )

There are 3 Steps involved in it

a Dec 31 Bad Debt Expense 24480 Allowance for Doubtful Ac... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

291-B-A-C-R (2043).docx

120 KBs Word File