Question: Presented below is the partial bond discount amortization schedule for Morales Corp. Morales uses the effective-interest method of amortization. Instructions(a) Prepare the journal entry to

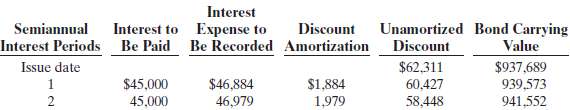

Presented below is the partial bond discount amortization schedule for Morales Corp. Morales uses the effective-interest method of amortization.

Instructions(a) Prepare the journal entry to record the payment of interest and the discount amortization at the end of period 1.(b) Explain why interest expense is greater than interest paid.(c) Explain why interest expense will increase each period.

Interest Discount Expense to Be Recorded Amortization Interest to Be Paid Unamortized Bond Carrying Discount $62,311 60,427 58,448 Semiannual Interest Periods Issue date Value $937,689 939,573 941,552 $45,000 45,000 $46,884 46,979 $1,884 1,979 2

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

a Interest Expense 46884 Discount on Bonds Payable 1... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-L (271).docx

120 KBs Word File