Question: Presented on the below are the comparative balance sheets for Lybeck Company at December 31. Additional information:1. Operating expenses include depreciation expense $65,000 and charges

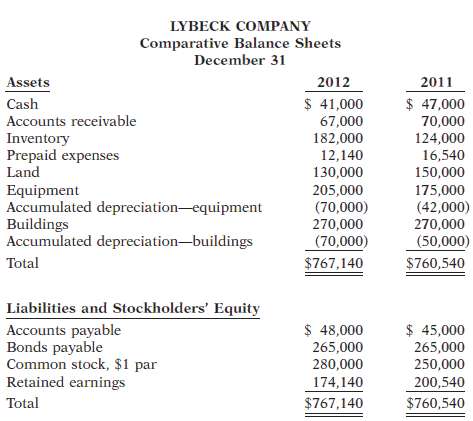

Presented on the below are the comparative balance sheets for Lybeck Company at December 31.

Additional information:1. Operating expenses include depreciation expense $65,000 and charges from prepaid expenses of $4,400.2. Land was sold for cash at cost.3. Cash dividends of $57,000 were paid.4. Net income for 2012 was $30,600.5. Equipment was purchased for $70,000 cash. In addition, equipment costing $40,000 with a book value of $23,000 was sold for $25,000 cash.6. 30,000 shares of $1 par value common stock were issued in exchange for land with a fair value of $30,000.InstructionsPrepare a statement of cash flows for 2012 using the indirect method.

LYBECK COMPANY Comparative Balance Sheets December 31 Assets 2012 2011 $ 41,000 67,000 182,000 12,140 $ 47,000 70,000 124,000 Cash Accounts receivable Inventory Prepaid expenses Land 16,540 130,000 150,000 175,000 Equipment Accumulated depreciation-equipment Buildings Accumulated depreciation-buildings 205,000 (42,000) (70,000) 270,000 (70,000) 270,000 (50,000) Total $767,140 $760,540 Liabilities and Stockholders' Equity $ 48,000 $ 45,000 Accounts payable Bonds payable Common stock, $1 par Retained earnings Total 265,000 265,000 280,000 250,000 174,140 $767,140 200,540 $760,540

Step by Step Solution

3.53 Rating (174 Votes )

There are 3 Steps involved in it

LYBECK COMPANY Statement of Cash Flows For the Year Ended December 31 2012 Cash flows from o... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-B-S-C-F (297).docx

120 KBs Word File