Question: Ratio Computations and Discussion Costner Company has been operating for several years, and on December 31, 2010, presented the following balance sheet. The net income

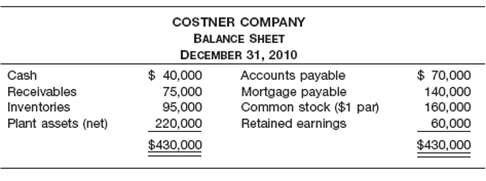

Ratio Computations and Discussion Costner Company has been operating for several years, and on December 31, 2010, presented the following balance sheet. The net income for 2010 was $25,000. Assume that total assets are the same in 2009 and 2010. Compute each of the following ratios. For each of the four indicate the manner in which it is computed and its significance as a tool in the analysis of the financial soundness of the company.

(a) Current ratio.

(c) Debt to total assets.

(b) Acid-test ratio.

(d) Rate of return onassets.

COSTNER COMPANY BALANCE SHEET DECEMBER 31, 2010 Accounts payable Mortgage payable Common stock ($1 Retained earnings $ 40,000 75,000 95,000 Cash Receivables $ 70,000 160,000 Inventories pan Plant assets (net) 220,000 60,000 $430,000 $430,000

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

a b Current ratio Current Assets Current Liabilities 210000 70000 300 Current ratio measures ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-F (94).docx

120 KBs Word File