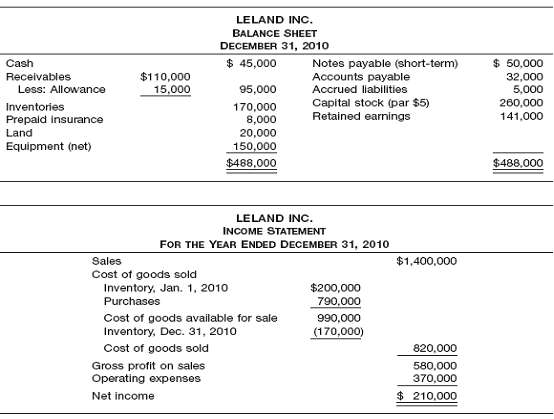

Question: Ratio Computations and Effect of Transactions Presented below is information related to Leland Inc. (a) Compute the following ratios or relationships of Leland Inc. Assume

Ratio Computations and Effect of Transactions Presented below is information related to Leland Inc.

(a) Compute the following ratios or relationships of Leland Inc. Assume that the ending account balances are representative unless the information provided indicates differently.

(1) Current ratio.

(2) Inventory turnover.

(3) Receivables turnover.

(4) Earnings per share.

(5) Profit margin on sales.

(6) Rate of return on assets on December 31, 2010.

(b) Indicate for each of the following transactions whether the transaction would improve, weaken, or have no effect on the current ratio of Leland Inc. at December 31, 2010.

(1) Write off an uncollectible account receivable, $2,200.

(2) Repurchase capital stock for cash.

(3) Pay $40,000 on notes payable (short-term).

(4) Collect $23,000 on accounts receivable.

(5) Buy equipment on account.

(6) Give an existing creditor a short-term note in settlement ofaccount.

LELAND INCC. BALANCE SHEET DECEMBER 31, 2010 $ 45,000 $ 50,000 Cash Notes payable (short-term) Accounts payable Accrued liabilities Capital stock (par $5) Recelvables Less: Allowance $110,000 15,000 32,000 5,000 95,000 260,000 Inventories Prepaid insurance 170,000 ,000 20,000 Retained earnings 141,000 Land Equipment (net) 150,000 $488,000 $488,000 LELAND INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2010 $1,400,000 Sales Cost of goods sold Inventory, Jan. 1, 2010 Purchases $200,000 790,000 Cost of goods available for sale Inventory, Dec. 31, 2010 990,000 (170,000) 820,000 Cost of goods sold Gross profit on sales Operating expenses 580,000 370,000 $ 210,000 Net income

Step by Step Solution

3.22 Rating (157 Votes )

There are 3 Steps involved in it

a 1 318000 87000 366 times 200000 170000 443 times or a... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-F (96).docx

120 KBs Word File