Question: Ray Heating & Cooling, Inc., was organized to provide heating and cooling service. It has just completed its second year of business. Its trial balance

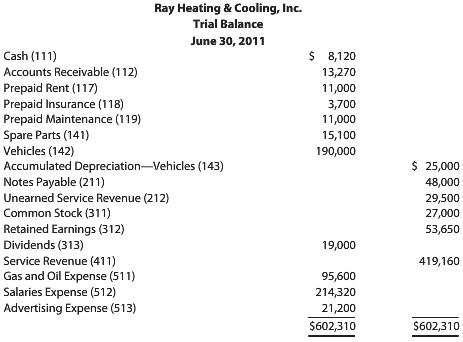

Ray Heating & Cooling, Inc., was organized to provide heating and cooling service. It has just completed its second year of business. Its trial balance appears below.

The following information is also available:

a. To obtain space at the airport, Ray Heating & Cooling paid two years’ rent in advance when it began the business.

b. An examination of insurance policies reveals that $1,400 expired during the year.

c. To provide regular maintenance for the vehicles, Ray Heating & Cooling deposited $11,000 with a local garage. An examination of maintenance invoices reveals charges of $9,879 against the deposit.

d. An inventory of spare parts shows $2,580 on hand.

e. Ray Heating & Cooling depreciates its service vehicles at the rate of 12.5 percent per year. No vehicles were purchased during the year.

f. A payment of $11,800 for one full year’s interest on notes payable is now due.

g. Unearned Service Revenue on June 30 includes $13,535 for contracts with local restaurants, but the service has not been provided yet.

h. Federal income taxes for the year are estimated to be $12,980.

REQUIRED

1. Determine adjusting entries and enter them in the general journal (Page 14).

2. Open ledger accounts for the accounts in the trial balance plus the following: Interest Payable (213), Income Taxes Payable (214), Rent Expense (514), Insurance Expense (515), Spare Parts Expense (516), Depreciation Expense—Vehicles (517), Maintenance Expense (518), Interest Expense (519), and Income Taxes Expense (520). Record the balances shown in the trial balance.

3. Post the adjusting entries from the general journal to the ledger accounts, showing proper references.

4. Prepare an adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet.

5. Do adjustments affect the cash flow yield? After the adjustments, is the cash flow yield for the year more or less than it would have been if the adjustments had not been made?

Ray Heating & Cooling, Inc. Trial Balance June 30, 2011 $ 8,120 Cash (111) Accounts Receivable (112) Prepaid Rent (117) Prepaid Insurance (118) Prepaid Maintenance (119) Spare Parts (141) Vehicles (142) Accumulated Depreciation-Vehicles (143) Notes Payable (211) Unearned Service Revenue (212) Common Stock (311) Retained Earnings (312) Dividends (313) Service Revenue (411) Gas and Oil Expense (511) Salaries Expense (512) Advertising Expense (513) 13,270 11,000 3,700 11,000 15,100 190,000 $ 25,000 48,000 29,500 27,000 53,650 19,000 419,160 95,600 214,320 21,200 $602,310 $602,310

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

1 Adjusting entries recorded in the general journal 2 Ledger accounts opened and balances recorded 3 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

328-B-A-G-F-A (3652).docx

120 KBs Word File