Question: Recording Four Adjusting Entries and Completing the Trial Balance Worksheet Red River Company prepared the following trial balance at the end of its first year

Recording Four Adjusting Entries and Completing the Trial Balance Worksheet

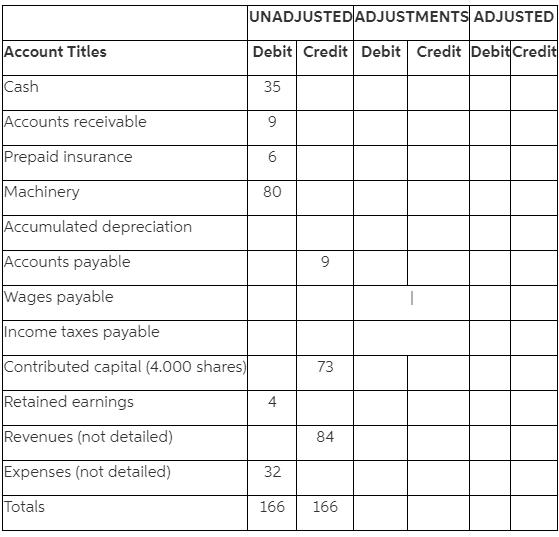

Red River Company prepared the following trial balance at the end of its first year of operations ending December 31, 2011. To simplify the case, the amounts given are in thousands of dollars.

Other data not yet recorded at December 31, 2011 include:

a. Insurance expired during 2011, $4.

b. Wages payable, $5.

c. Depreciation expense for 2011, $8.

d. Income tax expense, $9.

Required:

1. Prepare the adjusting entries for 2011.

2. Complete the trial balance Adjustments and Adjustedcolumns.

UNADJUSTEDADJUSTMENTS ADJUSTED Account Titles Debit Credit Debit Credit Debit Credit Cash 35 Accounts receivable 9. Prepaid insurance Machinery 80 Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital (4.000 shares) 73 Retained earnings 4 Revenues (not detailed) 84 Expenses (not detailed) 32 Totals 166 166

Step by Step Solution

3.29 Rating (161 Votes )

There are 3 Steps involved in it

Req 1 a Insurance expense E SE 4 Prepaid insurance A 4 b Wages expense E SE 5 Wages payab... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

72-B-A-F-S (802).docx

120 KBs Word File