Question: Refer again to question 9. Suppose that the continuously compounded return on Backwoods?s assets over the next year is normally distributed with a mean of

Refer again to question 9. Suppose that the continuously compounded return on Backwoods?s assets over the next year is normally distributed with a mean of 10 percent. What is the probability that Backwoods will default?

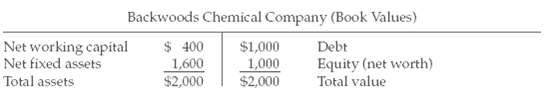

Look back to the first Backwoods Chemical example at the start of Section 24.5. Suppose that the firm?s book balance sheet is

The debt has a one-year maturity and a promised interest rate of 9 percent. Thus, the promised payment to Backwoods's creditors is $1,090. The market value of the assets is $1,200, and the standard deviation of asset value is 45 percent per year. The risk-free interest rate is 9 percent. Calculate the value of Backwoods debt and equity.

Backwoods Chemical Company (Book Values) Net working capital Net fixed assets $ 400 1,600 $2,000 $1,000 1,000 $2,000 Debt Equity (net worth) Total value Total assets

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Backwoods will default if the market value of the assets one year from now is les... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-F (29).docx

120 KBs Word File