Question: Refer to the data for problem regarding Long Beach Pharmaceutical Company. Required: Compute each divisions residual income for the year under each of the following

Refer to the data for problem regarding Long Beach Pharmaceutical Company.

Required:

Compute each division’s residual income for the year under each of the following assumptions about the firm’s cost of acquiring capital.

1. 12 percent.

2. 15 percent.

3. 18 percent.

Which division was more successful? Explain your answer.

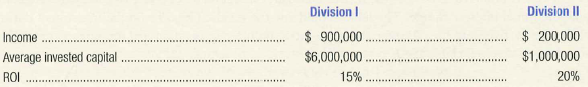

Division II Division I $ 900,000. $ 200,000 $1,000,000 20% Income Average invested capital . $6,000,000 15% ROI

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

1 Imputed interest rate of 12 Division I Division II Divisional profit 900000 200000 Less Imputed in... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

238-B-A-I (3325).docx

120 KBs Word File