Question: Refer to the data in E13-11 and assume instead that Mustafa Limited has chosen not to recognize paid sick leave until it is used, and

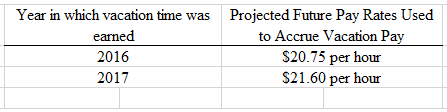

Refer to the data in E13-11 and assume instead that Mustafa Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at expected future rates of pay without discounting. Mustafa uses the following projected rates to accrue vacation time:

Instructions:

a) Prepare the journal entry(ies) to record the transactions related to vacation entitlement during 2016 and 2017.

b) Prepare the journal entry(ies) to record the transactions related to sick days during 2016 and 2017. Year-end amortization

c) Calculate the amounts of any liability for vacation pay and sick days that should be reported on the statement of financial position at December 31, 2016 and 2017. Accrued liability at year-end (vacation pay only):

Year in which vacation time was Projected Future Pay Rates Used to Accrue Vacation Pay $20.75 per hour $21.60 per hour earned 2016 2017

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

a Journal entry to classify into proper accounts Debit Credit 2016 To accrue the expense and liabili... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1189-B-C-A-C-A(2692).xlsx

300 KBs Excel File