Question: Repeat the analysis in Problem 7 for a private firm that has provided you with the following estimates of operating income for the 10 years,

Repeat the analysis in Problem 7 for a private firm that has provided you with the following estimates of operating income for the 10 years, for which you have the macroeconomic data:

Operating Income Year (in dollars thousands)

1985 ............ 463.05

1986 ............ 411.696

1987 ............ 483.252

1988 ............ 544.633

1989 ............ 550.65

1990 ............ 454.875

1991 ............ 341.481

1992 ............ 413.983

1993 ............ 567.729

1994 ............ 810.968

Data from Problem 7

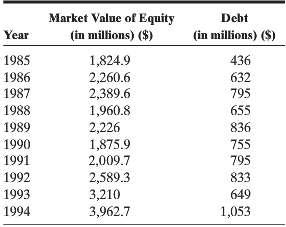

You are attempting to structure a debt issue for Eaton Corporation, a manufacturer of automotive components. You have collected the following information on the market values of debt and equity for the past 10 years:

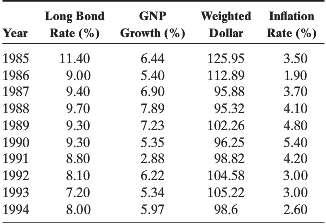

In addition, you have the following information on the changes in long-term interest rates, inflation rates, gross national product (GNP), and exchange rates over the same period.

Using this information,

a. Estimate the duration of this firm's projects. How would you use this information in designing the debt issue?

b. How cyclical is this company? How would that affect your debt issue?

c. Estimate the sensitivity of firm value to exchange rates. How would you use this information in designing the debt issue?

d. How sensitive is firm value to inflation rates? How would you use this information in designing the debt issue?

e. What factors might lead you to override the results of this analysis?

Market Value of Equity Debt Year (in millions) ($) (in millions) ($) 1985 1,824.9 2,260.6 2,389.6 1,960.8 2,226 1,875.9 2,009.7 436 1986 632 1987 795 1988 655 1989 836 1990 755 1991 795 1992 2,589.3 3,210 3,962.7 833 1993 649 1994 1,053

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

a To estimate the duration we regress changes in Op income against changes in the long bond rate Year Change in OI Change in Long Bond Rate 1986 1109 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

439-B-C-F-C-B (1646).docx

120 KBs Word File