RR Inc. operates an active business. Financial statements for the year ended December 31, 20X1 report a

Question:

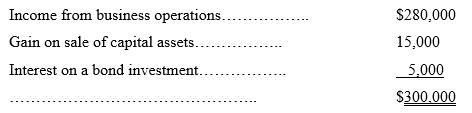

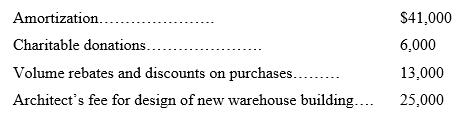

RR Inc. operates an active business. Financial statements for the year ended December 31, 20X1 report a net income before taxes of $300,000. The following additional information is provided:

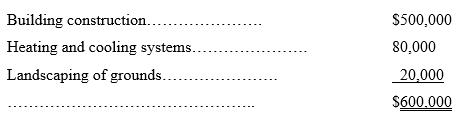

2. During the year RR completed construction of a new warehouse building and its cost of $600,000 was added to the balance sheet. The cost consists of the following:

The balance sheet of RR includes an amount for goodwill acquired from a previous business acquisition. During the year a goodwill impairment loss of $30,000 was deduced from the income from business operations.

Legal expenses include $2,000 for drafting the mortgage document for the new warehouse, $1,000 to investigate a zoning limitation on the new warehouse site, and $5,000 for the audit fee.

3. The balance sheet of RR includes an amount for goodwill acquired from a previous business acquisition. During the year, a goodwill impairment loss of $30,000 was deducted from the income from business operations.

4. Legal expenses include $2,000 for drafting the mortgage document for the new warehouse, $1,000 to investigate a zoning limitation on the new warehouse site, and $5,000 for the audit fee.

5. A management bonus of $60,000 was announced and accrued in September 201X. The bonus was paid in two equal installments on January 31 and April 30 of the following year.

7. Advertising and promotion includes $20,000 for airing a TV commercial, $30,000 for production of the TV commercial, $5,000 for club memberships in a sports-related facility to enhance business contacts and $12,000 for acquiring a permanent mailing list for seeking new customers.

8. Capital cost allowance and a cumulative eligible capital deduction for tax purposes has been correctly calculated as $58,000.

Required:

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold