Question: Savemore Supply, Co., shows the following financial statement data for 2014, 2015, and 2016. Prior to issuing the 2016 statements, auditors found that the ending

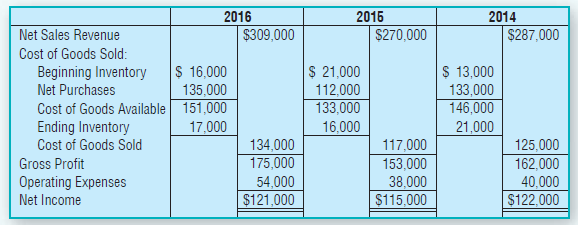

Savemore Supply, Co., shows the following financial statement data for 2014, 2015, and 2016.

Prior to issuing the 2016 statements, auditors found that the ending inventory for 2014 was overstated by $4,000 and that the ending inventory for 2016 was understated by $2,000. The ending inventory at December 31, 2015, was correct.

Requirements

1. State whether each year’s net income before corrections is understated or overstated, and indicate the amount of the understatement or overstatement.

2. Prepare corrected income statements for the three years.

3. What is the impact on the 2016 income statement if the 2014 inventory error is left uncorrected?

2016 $309,000 2016 $270,000 2014 $287,000 Net Sales Revenue Cost of Goods Sold: Beginning Inventory Net Purchases $ 21,000 112,000 $ 13,000 133,000 146,000 21,000 $ 16,000 135,000 Cost of Goods Available Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Net Income 151,000 133,000 16,000 134,000 117,000 153,000 38,000 $115,000 125,000 162,000 40,000 175,000 54,000 $121,000 $122,000

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

Req 1 Prior to correction Net income for the year was 2016 2015 2014 Understated by 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (3 attachments)

1350_60b9f89a4d558_607622.pdf

180 KBs PDF File

1350-B-M-A-I(3302).xlsx

300 KBs Excel File

1350_60b9f89a4d558_607622.docx

120 KBs Word File