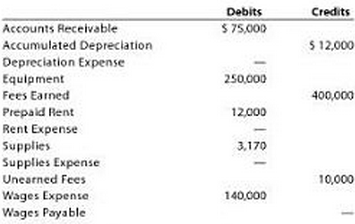

Question: Selected account balances before adjustment for Skylight Realty at June 30, 2012, the end of the current year, are shown below. Data needed for year-end

Selected account balances before adjustment for Skylight Realty at June 30, 2012, the end of the current year, are shown below.

Data needed for year-end adjustments are as follows:

a. Supplies on hand at June 30, $800.

b. Depreciation of equipment during year, $750.

c. Rent expired during year, $9,000.

d. Wages accrued but not paid at June 30, $1,700.

e. Unearned fees at June 30, $6,500.

f. Unbilled fees at June 30, $15,000.

Instructions

1. Journalize the six adjusting entries required at June 30, based on the data presented.

2. What would be the effect on the income statement if adjustments (b) and (e) were omitted at the end of year?

3. What would be the effect on the balance sheet if adjustment (b) and (e) were omitted at the end of the year?

4. What would be the effect on the “Net increase or decrease in cash” on the statement of cash flows if adjustments (b) and (e) were omitted at the end of the year?

Debits Credits S75,000 Accounts Receivable $ 12,000 Accumulated Depreciation Depreciation Expense Equipment Fees Earned 250,000 400,000 Prepaid Rent 12,000 Rent Expense Supplies Supplies Expense 3,170 Uncarned Fees 10,000 Wages Expense Wages Payable 140,000

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

1 a Supplies Expense 2370 Supplies 2370 Supplies used 3170 800 b Depreciation Expense 750 Accumulate... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

52-B-A-A-P (233).docx

120 KBs Word File