Several years ago, your brother opened Granite Appliance Repairs. He made a small initial investment and added

Question:

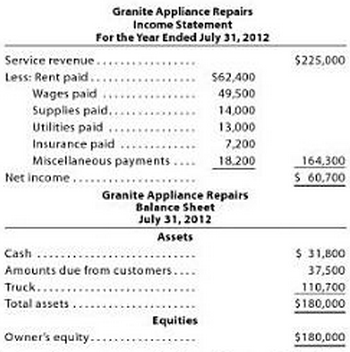

Several years ago, your brother opened Granite Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed. He withdrew money for living expenses at irregular intervals. As the business grew, he hired an assistant. He is now considering adding more employees, purchasing additional service trucks, and purchasing the building he now rents. To secure funds for the expansion, your brother submitted a loan application to the bank and included the most recent financial statements (shown below) prepared from accounts maintained by a part-time bookkeeper.

After reviewing the financial statements, the loan officer at the bank asked your brother if he used the accrual basis of accounting for revenues and expenses. Your bother responded that he did and that is why he included an account for “Amounts Due from Customer”. The loan officer then asked whether or not the account were adjusted prior to the preparation of the statements. Your brother answered that they had not been adjusted.

a. Why do you think the loan officer suspected that the accounts had not been adjusted prior to the preparation of the statements?

b. Indicate possible accounts that might need to be adjusted before an accrete set of financial statements could be prepared.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren