Question: Sherwin Company makes bicycles. Various divisions make components and transfer them to the Dayton division for assembly into final products. The Dayton division can also

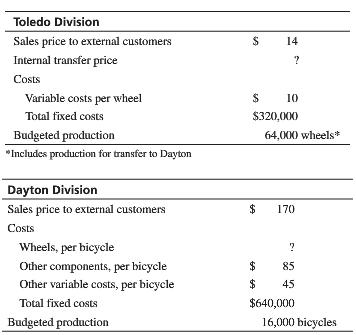

Sherwin Company makes bicycles. Various divisions make components and transfer them to the Dayton division for assembly into final products. The Dayton division can also buy components from external suppliers. The Toledo division makes the wheels, and it also sells wheels to external customers. All divisions are profit centers, and managers are free to negotiate transfer prices. Prices and costs for the Toledo and Dayton divisions are as follows:

Fixed costs in both divisions will be unaffected by the transfer of wheels from Toledo to Dayton.

1. Compute the maximum transfer price per wheel the Dayton division would be willing to pay to buy wheels from the Toledo division.

Toledo Division Sales price to external customens Internal transfer price Costs $ 14 Variable costs per wheel S I0 $320,000 Total fixed costs Budgeted production Includes production for transfer to Dayton 64,000 wheels* Dayton Division Sales price to external customers Costs $170 Wheels, per bicycle Other components, per bicycle Other variable costs, per bicycle Total fixed costs $ 85 $45 $640,000 Budgeted production 16,000 bicycles

Step by Step Solution

3.26 Rating (175 Votes )

There are 3 Steps involved in it

1 If wheels were available for 14 each in the market Dayton would not be willing to pay more than 14 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

345-B-M-A-B-P-C (1575).docx

120 KBs Word File