Question: Shown here are condensed income statements for two different companies ( both are organized as LLCs and pay no income taxes). Required 1. Compute times

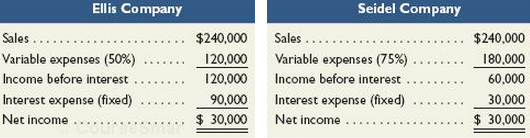

Shown here are condensed income statements for two different companies ( both are organized as LLCs and pay no income taxes).

Required

1. Compute times interest earned for Ellis Company.

2. Compute times interest earned for Seidel Company.

3. What happens to each company’s net income if sales increase by 10%?

4. What happens to each company’s net income if sales increase by 40%?

5. What happens to each company’s net income if sales increase by 90%?

6. What happens to each company’s net income if sales decrease by 20%?

7. What happens to each company’s net income if sales decrease by 50%?

8. What happens to each company’s net income if sales decrease by 80%?

Analysis Component

9. Comment on the results from parts 3 through 8 in relation to the fixed- cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

Ellis Company Seidel Company Sales . Variable expenses (75%) Income before interest Interest expense (fixed) Net income Sales .. Variable expenses (50%) Income before interest Interest expense (fixed) Net income $240,000 $240,000 120,000 180,000 60,000 30,000 120,000 90,000 $ 30,000 $ 30,000

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

1 2 3 Sales increase by 10 multiply prior sales by 110 Ellis Co Seidel Co Sales 264000 264000 Variable expenses 132000 198000 Income before interest 1... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

267-B-A-L (2992).docx

120 KBs Word File