Question: Singapore Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $60,000,

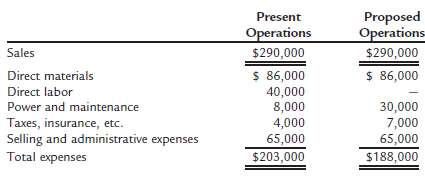

Singapore Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $60,000, the accumulated depreciation is $24,000, its remaining useful life is five years, and its residual value is negligible. On February 20, 2010, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that will cost $111,000. The automatic machine has an estimated useful life of five years and no significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations:

(a) Prepare a differential analysis report for the proposal to replace the machine. Include in the analysis both the net differential change in costs anticipated over the five years and the net annual differential change in costs anticipated. (b) Based only on the data presented, should the proposal be accepted?(c) What are some of the other factors that should be considered before a final decision is made?

Proposed Operations $290,000 $ 86,000 Present Operations $290,000 $ 86,000 40,000 8,000 4,000 65,000 $203,000 Sales Direct materials Direct labor Power and maintenance 30,000 7,000 65,000 Taxes, insurance, etc. Selling and administrative expenses Total expenses $188,000

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

a Proposal to Replace Machine February 20 2010 Annual costs and expensespresent machine 203000 Annua... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-M-A-P-P-S (97).docx

120 KBs Word File