Smart Safety, a three-year-old company, has been producing and selling a single type of bicycle helmet. Smart

Question:

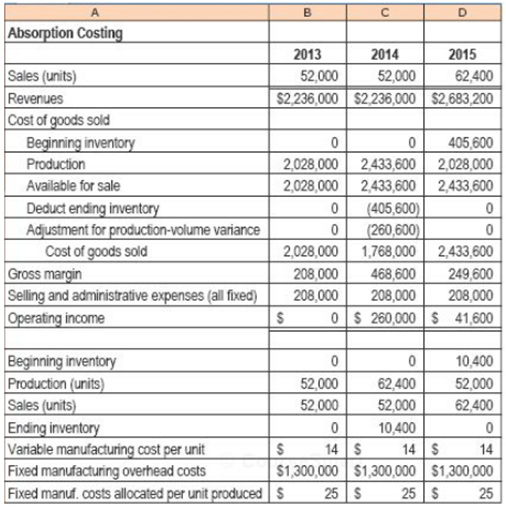

Smart Safety, a three-year-old company, has been producing and selling a single type of bicycle helmet. Smart Safety uses standard costing. After reviewing the income statements for the first three years, Stuart Weil, president of Smart Safety, commented, ?I was told by our accountants?and in fact, I have memorized?that our breakeven volume is 52,000 units. I was happy that we reached that sales goal in each of our first two years. But here?s the strange thing: In our first year, we sold 52,000 units and indeed we broke even. Then in our second year we sold the same volume and had a positive operating income. I didn?t complain, of course . . but here?s the bad part. In our third year, we sold 20% more helmets, but our operating income fell by more than 80% relative to the second year! We didn?t change our selling price or cost structure over the past three years and have no price, efficiency, or spending variances. . . so what?s going on?!?

Required

1. What denominator level is Smart Safety using to allocate fixed manufacturing costs to the bicycle helmets? How is Smart Safety disposing of any favorable or unfavorable production-volume variance at the end of the year? Explain your answer briefly.

2. How did Smart Safety?s accountants arrive at the breakeven volume of 52,000 units?

3. Prepare a variable costing-based income statement for each year. Explain the variation in variable costing operating income for each year based on contribution margin per unit and sales volume.

4. Reconcile the operating incomes under variable costing and absorption costing for each year, and use this information to explain to Stuart Weil the positive operating income in 2014 and the drop in operating income in 2015.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133428704

15th edition

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan