Question: Smoky Mountain Corporation makes two types of hiking bootsXtreme and the Pathfinder. Data concerning these two product lines appear below: The company has a traditional

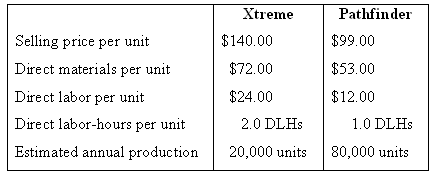

Smoky Mountain Corporation makes two types of hiking boots—Xtreme and the Pathfinder. Data concerning these two product lines appear below:

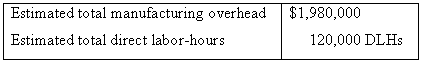

The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below:

Required:

1. Using Exhibit 8–12 as a guide, compute the product margins for the Xtreme and the Pathfinder products under the company’s traditional costing system.

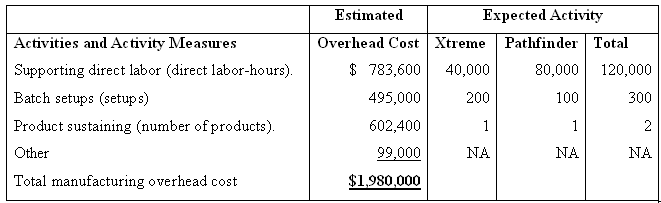

2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs):

Using Exhibit 8—10 as a guide, compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system.

3. Using Exhibit 8—13 as a guide, prepare a quantitative comparison of the traditional and activity-based cost assignments. Explain why the traditional and activity-based cost assignments differ.

Pathfinder Xtreme $140.00 $99.00 Selling price per unit $72.00 $53.00 Direct materials per unit Direct labor per unit $24.00 $12.00 Direct labor-hours per unit 2.0 DLHS 1.0 DLH: Estimated annual production 80,000 units 20,000 units

Step by Step Solution

3.46 Rating (172 Votes )

There are 3 Steps involved in it

1 Under the traditional direct laborhour based costing system manufacturing overhead is applied to products using the predetermined overhead rate comp... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-A-B-C (26).docx

120 KBs Word File