Question: Spreadsheets are especially useful for computing stock value under different assumptions. Consider a firm that is expected to pay the following dividends: and grow at

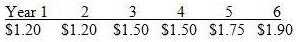

Spreadsheets are especially useful for computing stock value under different assumptions. Consider a firm that is expected to pay the following dividends:

and grow at 5 percent thereafter

A. Using an 11 percent discount rate, what would be the value of this stock?

B. What is the value of the stock using a 10 percent discount rate? A 12 percent discount rate?

C. What would the value be using a 6 percent growth rate after year 6 instead of the 5 percent rate using each of these three discount rates?

D. What do you conclude about stock valuation and its assumptions?

Year 1 S1.20 S1.20 S1.50 S1.50 S1.75 S1.90

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

a From the table calculated in Excel the value of the stock based on an 11 percent discount rate wou... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

335-B-F-F-M (4261).docx

120 KBs Word File