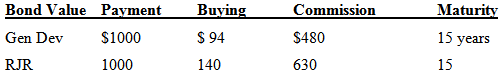

Question: A stockbroker has proposed two investments in low rated corporate bonds paying high interest rates and selling below their stated value (in other words, junk

A stockbroker has proposed two investments in low rated corporate bonds paying high interest rates and selling below their stated value (in other words, junk bonds), Both bonds are rated as equally risky. Which, if any, of the bonds should you buy if your MARR is 25%?

*At maturity the bondholder receives the last interest payment plus the bond stated value.

Bond Value Payment $1000 Buying Commission $480 Maturity 15 years $ 94 Gen Dev 630 140 RJR 1000 15

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Year Gen Dev RJR RJR Gen Dev 0 480 630 150 1 15 9... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (202).docx

120 KBs Word File