Stocks X and Y have the following probability distributions of expected future returns: a. Calculate the expected

Question:

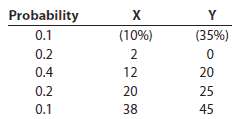

Stocks X and Y have the following probability distributions of expected future returns:

a. Calculate the expected rate of return, rY, for Stock Y (rX = 12%).b. Calculate the standard deviation of expected returns, ??X, for Stock X (??Y = 20.35%). Now calculate the coefficient of variation for Stock Y. Is it possible that most investors will regard Stock Y as being less risky than Stock X?Explain.

Transcribed Image Text:

Probability 0.1 0.2 (10%) (35%) 2 0.4 12 20 0.2 20 25 0.1 38 45

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

a b s X 1220 versus 2035 for Y CV Y 203514 1...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Accounting questions

-

Stocks A and B have the following probability distributions of expected future returns: Probability A B 0.4 (12%) (25%) 0.2 2 0 0.2 12 19 0.1 22 28 0.1 30 50 Calculate the expected rate of return, ,...

-

Stocks A and B have the following probability distributions of expected future returns: a. Calculate the expected rate of return, r ' B , for Stock B (r ' A = 12%). b. Calculate the standard...

-

Stocks R and S have the following probability distributions of returns: a. Calculate the expected return for each stock. b. Calculate the expected return of a portfolio consisting of 50 percent of...

-

Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1...

-

What are the documentation retention requirements of AS 1215?

-

which measures would you take to alleviate and/or prevent the adverse effects of breach on important work outcomes as an HR manager in a multinational organization.?

-

Again consider the 400 parts in Table 2.2. From this table, \[ P(D \mid F)=\frac{P(D \cap F)}{P(F)}=\frac{10}{400} / \frac{40}{400}=\frac{10}{40} \] Note that in this example all four of the...

-

The following are estimates for two stocks. The market index has a standard deviations of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B? b. Suppose that we...

-

Back Country Airlines has the following accounts and balances as of their year-end, December 31st, 20X1 (assume all balances are "normal"). In good form (including proper headings subtotals, labels,...

-

The company Smart Inc. is a company that produces Dog Shampoo in Toronto area. The results of the company, which has been mediocre for the past couple of years, have been presented in the annual...

-

A stock has a required return of 11%, the risk-free rate is 7%, and the market risk premium is 4%. a. What is the stocks beta? b. If the market risk premium increased to 6%, what would happen to the...

-

Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas: If the markets required rate of return is 14% and the...

-

Jersey Corporation acquired 100 percent of Lime Company on January 1, 20X7, for $203,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Additional...

-

Gravity-powered roller coasters have a motorized chain assembly that hauls the cars up to the top of the first hill. No additional source energy is supplied for the rest of the trip. What is the...

-

If you try to pound a nail into a board with a \(2.5-\mathrm{kg}\) rubber mallet, you will have less luck than if you use a 0. 8 kg steel hammer. Why?

-

Two cars collide inelastically on a city street. For the two-car system, which of the following are the same in any inertial reference frame: \((a)\) the kinetic energy, (b) the momentum, (c) the...

-

A red \(10-\mathrm{kg}\) cart is connected to a \(20-\mathrm{kg}\) cart by a relaxed spring of spring constant \(60 \mathrm{~N} / \mathrm{m}\). The \(20-\mathrm{kg}\) cart is resting against another...

-

You are watching a hockey game on your digital video recorder. Your team's goalie is at rest when he catches a \(0.16 \mathrm{~kg}\) puck moving straight toward him. The announcer says it was a...

-

In transistor amplifier design, a by-pass capacitor is connected across the emitter resistor \(R_{\mathrm{E}}\) to effectively short out the emitter resistor at signal frequencies. This design...

-

Ask students to outline the reasons why the various elements of culture (social structures and control systems, language and aesthetics, religion and other belief systems, educational systems, etc.)...

-

A structural formula for cholesterol is shown below. How many chiral carbon atoms are there in the cholesterol molecule? What is the configuration, R or S, of the carbon atom bonded to the OH group?...

-

Complete the table for unit sales, sales price, total revenues, and operating costs excluding depreciation.

-

Complete the depreciation data.

-

Fill in the blanks under Year 4 for the terminal cash flows, and complete the project cash flow line. Discuss working capital. What would have happened if the machinery were sold for less than its...

-

What strategies might you use to implement the personal change needed to support organizational change? What is the relevance of unity consciousness in organizational leadership, communications, and...

-

Recognizing the literature (and its limitations) for conveying policing organization, management, and change - what management/organizational changes are needed in policing today? Why? How do we set...

-

How do organizations effectively navigate the complexities of organizational change, integrating advanced change management methodologies to mitigate resistance and foster sustainable transformation?

Study smarter with the SolutionInn App