Study Appendix 16A. Unisys Corporation is a producer of computer-based information systems. The following actual data and

Question:

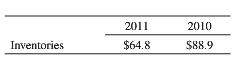

Study Appendix 16A. Unisys Corporation is a producer of computer-based information systems. The following actual data and descriptions are from the company’s 2011 annual report as of December 31 (in millions):

A footnote states that “Inventories are valued at the lower of cost or market. Cost is determined principally on the first-in, first-out method.”

The income statement for 2011 included the following (in millions):

Total revenues ……….. $3,853.8

Cost of revenue ……….. 2,866.8

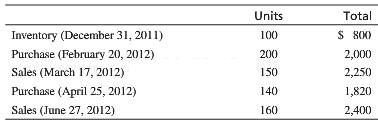

Suppose a division of Unisys had the accompanying data regarding computer parts that it acquires and resells to customers for maintaining equipment:

1. For these computer parts only, prepare a tabulation of the cost-of-goods-sold section of the income statement for the 6 months ended June 30, 2012. Support your computations. Round totals to the nearest dollar. Show your tabulation for four different inventory methods: (a) FIFO, (b) LIFO, (c) weighted-average, and (d) specific identification.

For part d, assume that the purchase of February 20 was identified with the sale of March 17. Also assume that the purchase of April 25 was identified with the sale of June 27; the additional units sold were identified with the beginning inventory.

2. By how much would income taxes differ if Unisys used (a) LIFO instead of FIFO for this inventory item? (b) weighted average instead of FIFO? Assume a 40% tax rate.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta