Company L and Company E have reached agreement in principle to combine their operations. However, the boards

Question:

Company L and Company E have reached agreement in principle to combine their operations. However, the boards of directors are undecided as to the best way to accomplish the combination. Several alternatives are under consideration:

1. L acquires the net assets of E (including the liabilities) for $2,000,000 cash.

2. L acquires all of the assets of E (but not the liabilities) for $2,800,000 cash.

3. L acquires the net assets of E by issuing 120,000 shares in L, valued at $2,000,000.

4. L acquires all of the shares of E by exchanging them for 120,000 newly issued shares in L.

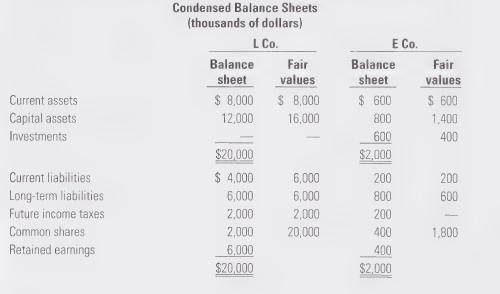

The current, condensed balance sheets of L and of E are shown below. Prior to the combination, L has 480,000 shares outstanding and E has 60,000 shares outstanding.

Required:

a. In a comparative, columnar format, show how the consolidated balance sheet of L would appear immediately after the combination under each of the four alternatives using the purchase method.

b. For each of the four alternatives, briefly state who owns the shares of each corporation and whether L and E are related companies.

Step by Step Answer: