On January 1, 2005, Power Corporation purchased 80% of the outstanding shares of Spencer Corporation for $2,500,000

Question:

On January 1, 2005, Power Corporation purchased 80% of the outstanding shares of Spencer Corporation for $2,500,000 in cash. On that date, Spencer Corporation’ss common shares had a carrying value of $2,000,000 and retained earnings of $1,000,000. On January 1, 2005, all of Spencer's identifiable assets and liabilities had fair values that were equal to their carrying values except for:

1. A building that had an estimated fair value of $600,000 less than its carrying value; its remaining useful life was estimated to be 10 years.

2. A long-term liability with a fair value of $500,000 less than its carrying value;

the liability matures on December 31, 2012.

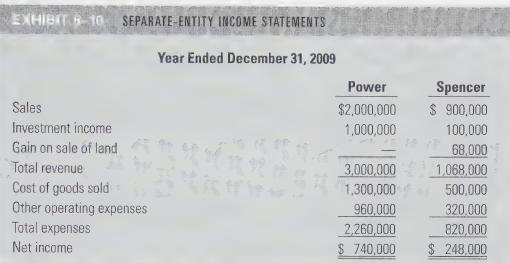

The income statements of Power Corporation and Spencer Corporation for the year ended December 31, 2009, are shown in Exhibit 6-10. Additional information is as follows:

1. On January 1, 2006, Spencer sold a machine to Power for $210,000. Spencer originally paid $400,000 for the machine on January 2, 2001. At the original date of purchase by Spencer, the machine had an estimated useful life of 20 years with no estimated salvage value. There has been no change in these estimates—

the machine still retains its value in use.

2. Both companies use the straight-line method for all depreciation and amortization.

3. During 2008, the following intercompany inventory sales occurred:

- Power sold $500,000 of merchandise to Spencer, $100,000 of which is in Spencer's inventory at 2008 year-end.

- Spencer sold $300,000 of merchandise to Power, $70,000 of which is in Power's inventory at the end of 2008.

4. During 2009, the following intercompany inventory sales occurred:

Power sold $400,000 of merchandise to Spencer, $90,000 of which is in Spencer's inventory at 2009 year-end. - Spencer sold $250,000 of merchandise to Power, $60,000 of which is in Power's inventory at the end of 2009.

5. Intercompany inventory transactions are priced to provide Power with 30%

gross margin (on sales price) and Spencer with 40% gross profit (on sales).

Both companies use the first-in first-out inventory cost flow assumption.

6. On September 1, 2009, Spencer sold a parcel of land to Power Company for $133,000 that it had originally purchased for $65,000.

7. During 2009, Power declared and paid $250,000 in dividends, while Spencer declared and paid $40,000 in dividends.

8. Power accounts for its investment in Spencer on the cost basis.

9. There was no impairment of goodwill at the end of 2009.

Required:

a. Prepare a consolidated income statement for Power Corporation for the year ending December 31, 2009. Show supporting calculations for each amount in the consolidated income statement.

b. Independently, calculate Power Corporation's net income using equity-basis reporting.

Step by Step Answer: