Parent Ltd. acquired 100% of the voting shares of Sub Ltd. on January 1, 2006, for $1,255,000.

Question:

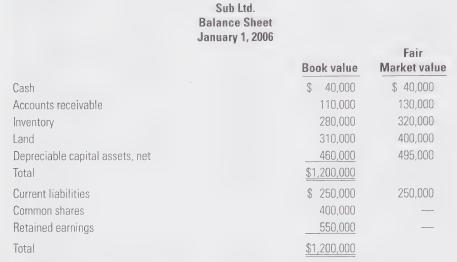

Parent Ltd. acquired 100% of the voting shares of Sub Ltd. on January 1, 2006, for $1,255,000. The financial statement of Sub Ltd. on the date of acquisition was as follows:

The inventory will be sold and the accounts receivable collected within seven months, and the depreciable capital assets will be depreciated over 10 years, straight-line, with no salvage value.

During 2006, Sub Ltd. sold inventory to Parent Ltd. for $150,000 with a 20% markup on retail. At the end of 2006, $30,000 (at retail) of these goods were still in the inventory. Parent Ltd. sold $200,000 of goods to Sub Ltd. during 2006, with a 25% markup on retail, and $40,000 (at retail) of these were still in inventory at the end of 2006. All of these goods remaining in inventory were sold during 2007.

During 2007, Parent Ltd. sold $180,000 of goods to Sub Ltd. with a 25% markup on retail, and $50,000 (at retail) of these goods were in inventory at the end of 2007. In addition, Sub Ltd. sold goods to Parent Ltd. for $220,000 with a 20% markup on retail, and $60,000 (at retail) of these were still in inventory at the end of 2007. All of these remaining goods were sold during 2008.

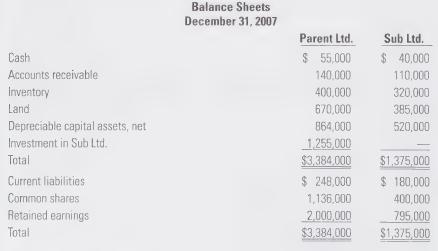

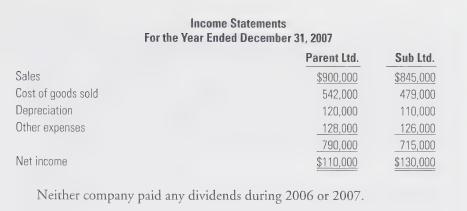

The following are the financial statements of the two companies at December 31, 2007:

Required:

Calculate the following, considering all dates carefully:

1. Investment income, under the equity method, for 2006.

2. Consolidated net income for 2007.

3. Consolidated balance of accounts receivable at December 31, 2007.

4. Consolidated balance of depreciable capital assets at December 31, 2007.

5. Consolidated balance of inventory at December 31, 2007.

Step by Step Answer: