Lana Priest set up a home sewing business on 1 July 2019. Usually, Lana collects $20 per

Question:

Lana Priest set up a home sewing business on 1 July 2019. Usually, Lana collects $20 per hour for sewing on the completion of each day’s work and pays for the maintenance of her machine with cash.

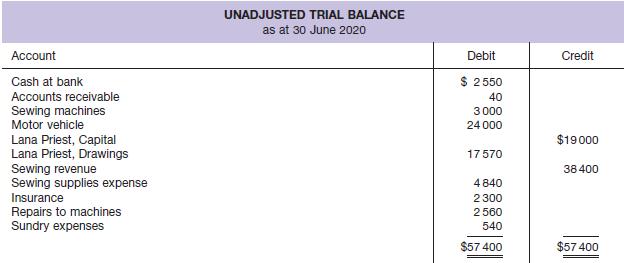

Lana did an accounting subject at secondary school and so has kept her own accrual‐based accounting records. At the end of the first year, Lana produced the following unadjusted trial balance.

The following adjustments were required at the year‐end.

1. Sewing supplies on hand at year‐end, $230.

2. An account was received for repairs done to machines before year‐end but not recorded, $270.

Ignore the GST in your answers.

Required

(a) Prepare an income statement for the year ended 30 June 2020 using accrual accounting.

(b) Prepare an income statement for the year ended 30 June 2020 using cash accounting.

(c) Lana was not sure whether she could use cash accounting rather than accrual accounting for her business records. From the information provided, decide whether Lana should use accrual or cash accounting, and explain to her the reasons for your decision.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie