Long Weekend Ltd suffered a severe drop in sales and profit performance for the year ended 30

Question:

Long Weekend Ltd suffered a severe drop in sales and profit performance for the year ended 30 June 2019. The income statement revealed that net sales were $1 500 000 with a profit of

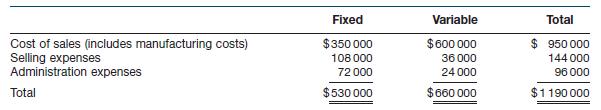

$310 000. Unit sales were 300 000, and total costs were $1 190 000. A breakdown of costs and expenses is presented below.

In response to the bad result, management is considering a number of options for the year ending 30 June 2020 to try to improve performance. Independent policy options being considered are set out below.

1. Update factory machinery and production methods to adjust the mix of fixed and variable cost of sales (which includes manufacturing costs) to 40% fixed and 60% variable.

2. Increase the selling price by 15%, with no changes to costs and expenses but unit sales will decrease 10%.

3. Change the manner in which sales staff are remunerated. It is proposed to pay sales staff on the basis of a base salary of $32 000 plus a 5% commission on net sales. The current policy is to pay fixed total salaries of $105 000.

Required

(a) Calculate the break‐even point in dollars of sales for the year ended 30 June 2019.

(b) Calculate the break‐even point and profit for each of the options being considered by management.

(c) What action should be recommended to management? Explain why.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie