Mike Triump is the owner/manager for Online Logistic Solutions, which is a small transport and courier company

Question:

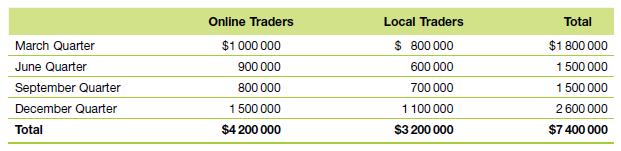

Mike Triump is the owner/manager for Online Logistic Solutions, which is a small transport and courier company that provides logistic services to business. Mike is about to start the budget process for 2018. His marketing manager has contacted customers and analysed market trends, and expects sales to online traders to increase by 30 per cent in 2018. One of the major customers has predicted that their sales will increase 109 per cent next year. Mike is very confident that his business will meet the estimated sales growth for 2018. In contrast, transport to local traders is expected to increase by no more than 3 per cent in 2018. The sales activity for 2017 was as follows:

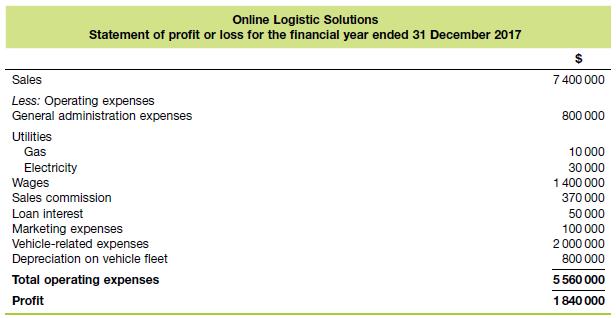

Operating expenses

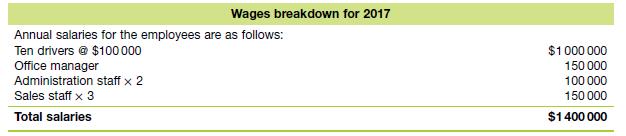

Given the expected increase in sales volumes for 2018, the Office Manager has held meetings with the drivers and sales personnel to identify resources needed to support the increased activity. To assist their deliberations, the statement of profit or loss for 2017 was used as a basis for discussion.

Additional information

The following changes are expected in 2018.

• A new enterprise bargaining agreement is expected to be approved which will increase salaries by 4 percent.

• Due to uncertainty regarding the cost of fuel an expected increase of 1 percent is to be allowed in the budget.

• The fuel is included in the vehicle-related expenses and is 50 per cent of the expense.

• Utilities are expected to increase by 2 percent.

• To encourage sales staff to boost sales to the expected levels, the sales commission will increase from 5 percent to 5.5 percent of sales.

• Marketing-related expenses are expected to increase 25 percent.

• General administration expenses are expected to increase by 1 percent.

• Loan interest and depreciation for 2018 will be the same as for 2017.

Required

Prepare a sales budget, operating expenses budget and a budgeted statement of profit or loss for Online Logistic Solutions for 2018 taking in consideration revenue and cost changes identified by the business.

Step by Step Answer:

Accounting Business Reporting For Decision Making

ISBN: 9780730363415

6th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver