Sophisticated medical scanning equipment was purchased on credit and installed for $800 800 ($728 000 + $72

Question:

Sophisticated medical scanning equipment was purchased on credit and installed for $800 800 ($728 000 +

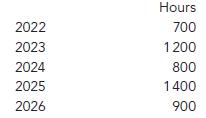

$72 800 GST) on 16 July 2021. The residual value is only as scrap metal and is considered immaterial. Due to the components within the equipment, it is to be depreciated using units of use based on 5000 hours’ total usage. For the years ended 30 June, usage in hours is initially anticipated to be:

Calculate the anticipated depreciation for each year using the units of use depreciation worksheet.

For the year to 30 June 2022, actual usage was 625 hours; and for the year to 30 June 2023 it was 1150 hours. Prepare to 30 June 2023 a depreciation worksheet and extract general ledger accounts for equipment, accumulated depreciation and depreciation. Then prepare extracts of the income statement and balance sheet for the year ended 30 June 2023.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson