The directors of Greenfields Ltd have prepared functional budgets for the four months ending 30 April 2005.

Question:

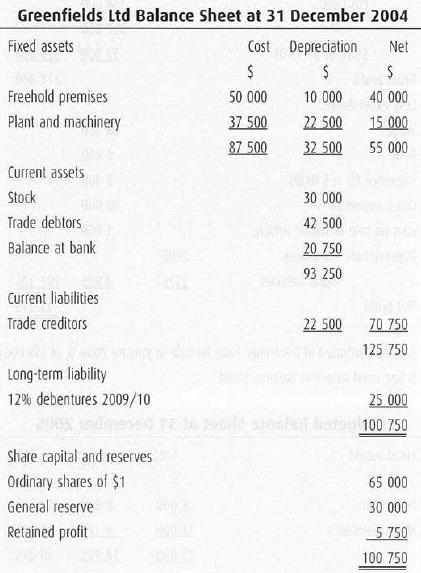

The directors of Greenfields Ltd have prepared functional budgets for the four months ending 30 April 2005. To discover the effect that the budgets will have on the company at the end of the four months, they require the accountant to prepare master budgets. The accountant is provided with the following data.

Further information

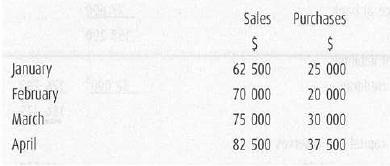

1. Sales and purchases for the four months from January to April 2005 are budgeted to be:

2. 40% of sales are to cash customers; one month's credit is allowed on the remainder.

3. The company pays for its purchases in the month following purchase.

4. Selling and distribution expenses amount to 10% of sales and are paid in the month in which they are incurred.

5. Administration expenses amount to $20 000 per month and are paid in the month in which they are incurred.

6. Stock at the 30 April 2005 is estimated to be valued at $22 500.

7. Additional plant and machinery costing $60 000 will be purchased on 1 March 2005.

8. Annual depreciation of fixed assets is based on cost as follows: Freehold premises 3%; plant and machinery 20%. 50% of all depreciation is to be charged to selling and distribution expenses, and the balance to administration expenses.

9. Debenture interest is payable half-yearly on 30 June and 31 December.

10. A dividend of $0.10 per share will be paid on the ordinary shares on 30 April 2005.

11. $25 000 will be transferred to the General Reserve on 30 April 2005.

Required

(a) Prepare a cash budget for each of the four months from January 2005 to 30 April 2005.

(b) Prepare a budgeted Profit and Loss Account for the four months ending 30 April 2005 in as much detail as possible.

(c) Prepare a budgeted Balance Sheet as at 30 April 2005 in as much detail as possible.

Step by Step Answer: