Beacon Chemicals plc is considering buying some equipment to produce a chemical named X14. The new equipments

Question:

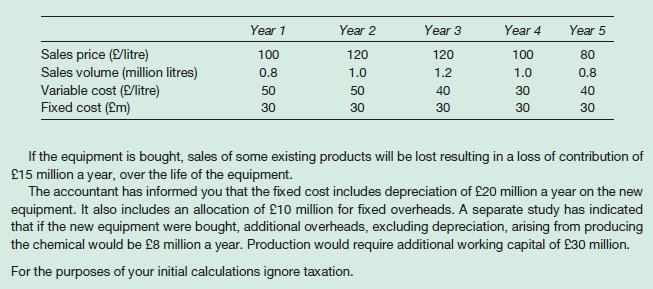

Beacon Chemicals plc is considering buying some equipment to produce a chemical named X14. The new equipment’s capital cost is estimated at £100 million. If its purchase is approved now, the equipment can be bought and production can commence by the end of this year. £50 million has already been spent on research and development work. Estimates of revenues and costs arising from the operation of the new equipment are:

Required:

(a) Deduce the relevant annual cash flows associated with buying the equipment.

(b) Deduce the payback period.

(c) Calculate the net present value using a discount rate of 8 per cent.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney

Question Posted: