Helsim Ltd is a wholesaler and distributor of electrical components. The most recent draft financial statements of

Question:

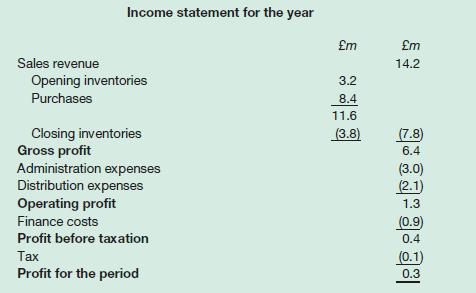

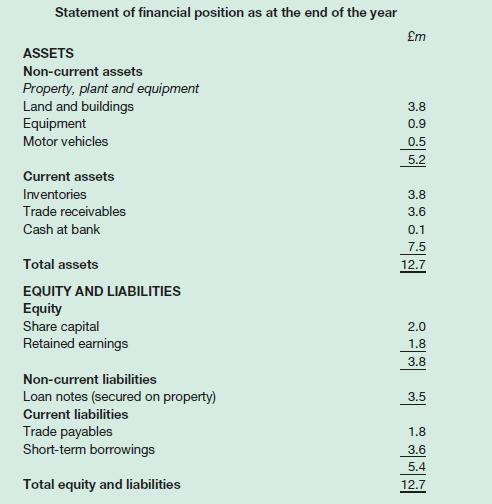

Helsim Ltd is a wholesaler and distributor of electrical components. The most recent draft financial statements of the business included the following:

Notes:

1. Land and buildings are shown at their current market value. Equipment and motor vehicles are shown at cost less accumulated depreciation.

2. No dividends have been paid to ordinary shareholders for the past three years.

In recent months, trade payables have been pressing for payment. The managing director has therefore decided to reduce the level of trade payables to an average of 40 days outstanding. To achieve this, he has decided to approach the bank with a view to increasing the overdraft (the short-term borrowings comprise only a bank overdraft). The business is currently paying 10 per cent a year interest on the overdraft.

Required:

(a) Comment on the liquidity position of the business.

(b) Calculate the amount of finance required to reduce trade payables, from the level shown on the statement of financial position, to an average of 40 days outstanding.

(c) State, with reasons, how you consider the bank would react to the proposal to grant an additional overdraft facility.

(d) Identify four sources of finance (internal or external but excluding a bank overdraft) that may be suitable to finance the reduction in trade payables, and state, with reasons, which of these you consider the most appropriate.

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney