How will the eventual payment of the outstanding sales commission (Example3.4) and the electricity bill for the

Question:

How will the eventual payment of the outstanding sales commission (Example 3.4) and the electricity bill for the last quarter (Example 3.5) be dealt with in the accounting records of Domestic Ltd?

Data from Example 3.4

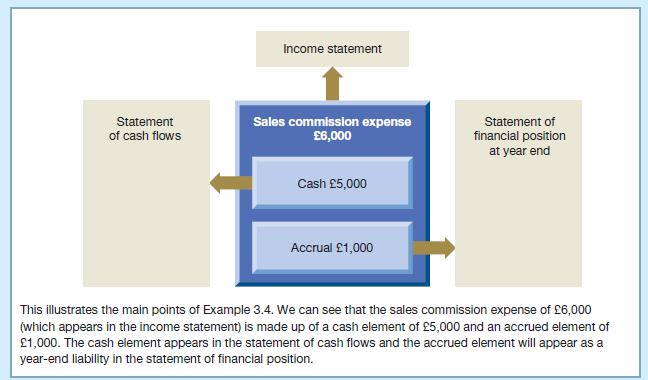

Domestic Ltd, a retailer, sells household electrical appliances. It pays its sales staff a commission of 2 per cent of sales revenue generated. Total sales revenue for last year amounted to £300,000. This means that the commission to be paid on sales for the year will be £6,000. However, by the end of the year, the amount of sales commission actually paid was only £5,000. If the business reported this amount as the sales commission expense, it would mean that the income statement would not reflect the full expense for the year. This would contravene the matching convention because not all of the expenses associated with the revenue of the year would have been matched with it in the income statement. This will be remedied as follows:

Sales commission expense in the income statement will include the amount paid plus the amount outstanding (that is, £6,000 = £5,000 + £1,000).

The amount outstanding (£1,000) represents an outstanding liability at the end of the year and will be included under the heading accrued expenses, or ‘accruals’, in the statement of financial position. As this item will have to be paid within 12 months of the year end, it will be treated as a current liability.

The cash will already have been reduced to reflect the commission paid (£5,000) during the period.

Figure 3.3

Data from Example 3.5

Domestic Ltd has reached the end of its reporting period and has only paid for electricity for the first three quarters of the year (amounting to £1,900). This is simply because the electricity company has yet to send out bills for the quarter that ends on the same date as Domestic Ltd’s year end. The amount of Domestic Ltd’s bill for the last quarter of the year is £500. In this situation, the amount of the electricity expense outstanding is dealt with as follows:

Electricity expense in the income statement will include the amount paid, plus the amount of the bill for the last quarter of the year (that is, £1,900 + £500 = £2,400) in order to cover the whole year.

The amount of the outstanding bill (£500) represents a liability at the end of the year and will be included under the heading ‘accrued expenses’ in the statement of financial position. This item would normally have to be paid within 12 months of the year end and will, therefore, be treated as a current liability.

The cash will already have been reduced to reflect the amount (£1,900) paid for electricity during the period.

This treatment will mean that the correct figure for the electricity expense for the year will be included in the income statement. It will also have the effect of showing that, at the end of the reporting period, Domestic Ltd owed the amount of the last quarter’s electricity bill. Dealing with the outstanding amount in this way reflects the dual aspect of the item and will ensure that the accounting equation is maintained.

Domestic Ltd may wish to draw up its income statement before it is able to discover how much it owes for the last quarter’s electricity. In this case it is quite normal to make an estimate of the amount of the bill and to use this amount as described above.

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney