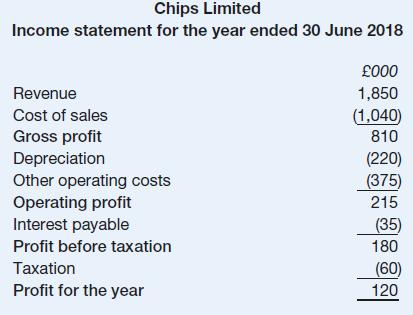

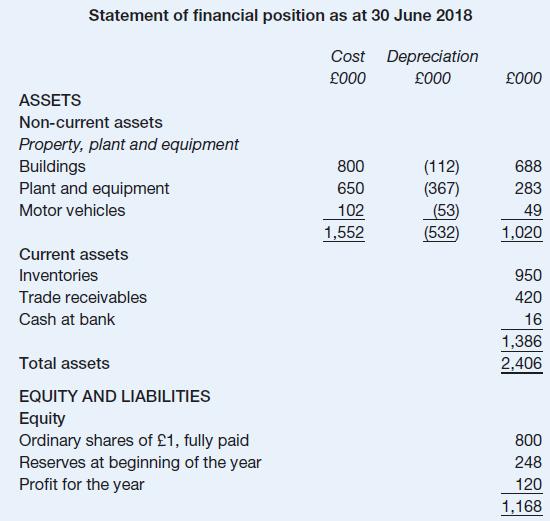

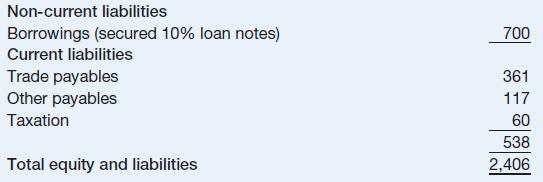

Presented below is a draft set of financial statements for Chips Limited. The following additional information is

Question:

Presented below is a draft set of financial statements for Chips Limited.

The following additional information is available:

1 Purchase invoices for goods received on 29 June 2018 amounting to £23,000 have not been included. This means that the cost of sales figure in the income statement has been understated.

2 A motor vehicle costing £8,000 with depreciation amounting to £5,000 was sold on 30June 2018 for £2,000, paid by cheque. This transaction has not been included in the company’s records.

3 No depreciation on motor vehicles has been charged. The annual rate is 20 per cent of cost at the year end.

4 A sale on credit for £16,000 made on 1 July 2018 has been included in the financial statements in error. The cost of sales figure is correct in respect of this item.

5 A half-yearly payment of interest on the secured loan due on 30 June 2018 has not been paid.

6 The tax charge should be 30 per cent of the reported profit before taxation. Assume that it is payable, in full, shortly after the year end.

Required:

Prepare a revised set of financial statements incorporating the additional information in 1to 6 above.

Step by Step Answer:

Accounting And Finance For Non-Specialists

ISBN: 9781292244013

11th Edition

Authors: Eddie McLaney, Peter Atrill