Arkwright Mills plc is considering expanding its production of a new yarn, code name X15. The plant

Question:

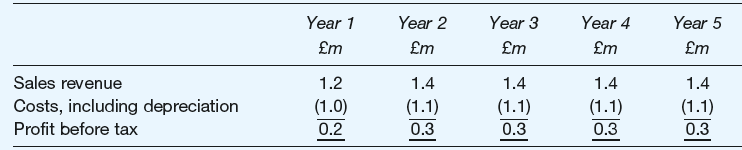

The following results are projected for the new yarn:

Tax is charged at 50 per cent on annual profits (before tax and after depreciation) and paid one year in arrears. Depreciation of the plant has been calculated on a straight-line basis. Additional working capital of £0.6 million will be required at the beginning of the project and released at the end of Year 5. You should assume that all cash flows occur at the end of the year in which they arise.

Required:

(a) Prepare a statement showing the incremental cash flows of the project relevant to a decision concerning whether or not to proceed with the construction of the new plant.

(b) Compute the net present value of the project using a 10 per cent discount rate.

(c) Compute the payback period to the nearest year. Explain the meaning of this term.

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney