PART A (a) Explain the advantages and disadvantages of using factoring or discounting. 4 marks (b) Discuss

Question:

PART A

(a) Explain the advantages and disadvantages of using factoring or discounting. 4 marks

(b) Discuss what type of businesses would benefit from floor-plan finance. 4 marks

(c) Graham Ltd is a profitable manufacturing company in the clothing industry and currently has a net working capital of 150 per cent. Cockcroft Ltd commenced operations this year in the biotechnology industry and is currently trialling a new pharmaceutical drug to cure cancer. Cockcroft Ltd’s net working capital is 15 per cent. Provide reasons why these two entities could have vastly different net working capital and how both could still be in existence in five years’ time. 4 marks

PART B

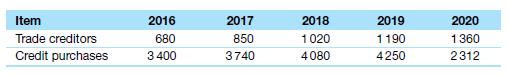

(a) The following table illustrates key figures from Robertson Ltd’s statement of profit or loss and statement of financial position for the five-year period ending 30 June 2020.

Calculate the creditors turnover (in days) for Robertson Ltd for the years 2017 to 2020. Describe the trend over the four-year period. Comment on the trend above if Robertson Ltd’s average credit limit with its suppliers is 30 days. 9 marks

(b) Robertson Ltd requires external finance to fund a new business venture which will be developed over the next five years. The company is considering the options of an instalment loan and an interest-only loan. Discuss the advantages and disadvantages of both of these forms of finance. 6 marks

(c) Robertson Ltd is also considering a 180-day commercial bill at 7 per cent yield including fees. The face value of the commercial bill is $400000. How much will Robertson Ltd receive? 5 marks

(d) Robertson Ltd’s average collection period for its accounts receivable is 45 days. Its credit terms are 30 days. What strategies can Robertson Ltd implement to reduce its collection period to a period closer to its credit terms? 5 marks

Step by Step Answer:

Accounting Business Reporting For Decision Making

ISBN: 9780730369325

7th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver, David Bond