A colleague who has just started studying accounting has read in another book that companies without current

Question:

A colleague who has just started studying accounting has read in another book that companies without current ratios of 2:1 and quick (acid test) ratios of 1:1 will find it difficult to meet their current liabilities as they fall due. She has just noticed your current and quick ratio calculations for Samoco plc in Question 7.1 and has concluded that the company is about to collapse. Using the information in Question 7.1, ratios that you have already calculated and details of when liabilities can be assumed to be due for payment presented below, calculate the maximum amount of the current liabilities of Samoco plc that could be due for repayment on the day after the statement of financial position date (1 June 2019 and 1 June 2018). Draw up arguments to put to your colleague to show her that a simple reliance on current and quick ratios as an indicator of short-term liquidity fails to address all the relevant issues.

For the purposes of this exercise you should assume that current liabilities are due for payment as follows:

• Bank loans: repayable in 12 monthly instalments

• Trade payables: repayable according to your payables days calculations in Question 7.1

• Current tax: due in four instalments: three months, six months, nine months and twelve months after the statement of financial position date

• Other payables: assume that 20% of this figure is payable immediately

• Dividends: due for payment in August 2019 and August 2018

You can assume that there are 360 days during the financial year on which Samoco plc’s shops are open and trading.

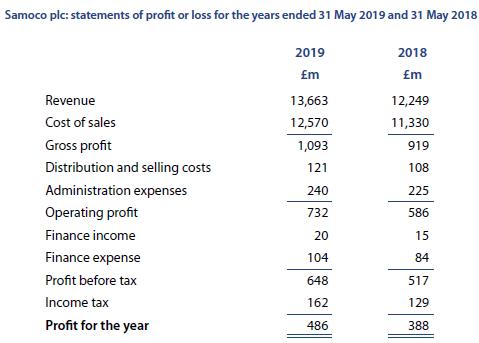

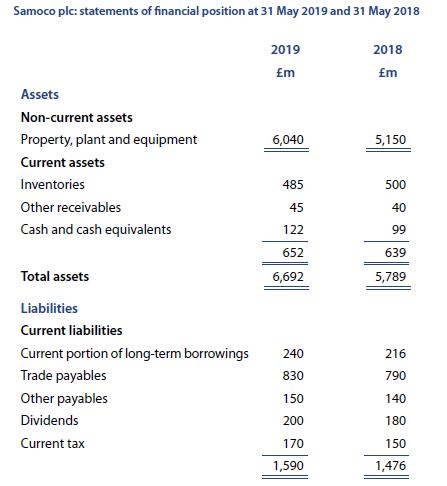

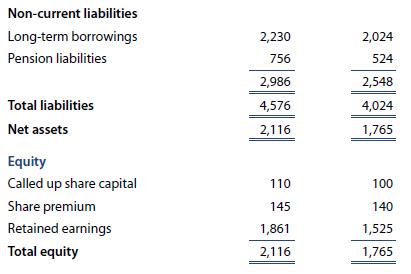

Data from Exercise 7.1

Samoco plc operates a chain of in town grocery convenience stores and edge of town supermarkets across the UK. The company is expanding rapidly and is adding new stores every year. Below are the statements of profit or loss for the company for the years ended 31 May 2019 and 31 May 2018 together with statements of financial position at those dates.

Notes to the above financial statements:

• Samoco plc’s sales are made on an entirely cash basis, with no credit being allowed to customers at its convenience stores and supermarkets. Therefore, at 31 May 2019 and 31 May 2018 there were no monies owed by trade receivables.

• Finance expense is made up entirely of interest payable on the long-term borrowings.

• Samoco plc’s long-term borrowings are repayable by equal annual instalments over the next 10 years.

Step by Step Answer: