Brockbank Builders Ltd is preparing a cash budget for May and June of 2025. Past records reveal

Question:

Brockbank Builders Ltd is preparing a cash budget for May and June of 2025. Past records reveal that 20% of all credit sales are collected during the month of sale, 60% in the month following the sale, 10% in the second month following the sale and 10% in the third month following the sale. The company pays for 75% of purchases in the month after purchase, and the balance is paid in the month following that.

Selling expenses amount to \($6600\) per month plus 15% of monthly sales. Administrative expenses are estimated to be \($13\) 200 per month, which includes \($4800\) of depreciation expense. Finance expenses are \($1200\) per month. All selling and distribution, administrative, and finance and other expenses (except depreciation) are paid for when incurred.

It is planned to purchase equipment during May 2025 at a cost of \($6600\). A \($9000\) loan payable will be repaid during June 2025. The interest due at maturity will be \($1650\). The company’s expected Cash at Bank balance at 1 May 2025 is \($13\) 500.

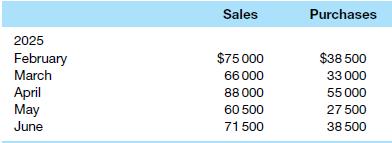

Estimated sales and purchases data are as follows.

Required Ignoring GST, prepare a cash budget for May and June 2025, by month and in total.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie