Hard Pressed Ironings financial year ends on 30 June. Make the necessary adjusting entries at year-end using

Question:

Hard Pressed Ironing’s financial year ends on 30 June. Make the necessary adjusting entries at year-end using the following information. Ignore GST.

1. On 1 October, Hard Pressed Ironing borrowed $60 000 from Australia National Bank at 9% interest. The interest is paid on the 1st of each month.

2. Rent of $4800 for July was paid on 28 June and debited to the expense account.

3. The annual depreciation on equipment is estimated to be $6500. The 1 July balance in the Accumulated Depreciation account was $13 000.

4. Hard Pressed Ironing purchased a 1-year insurance policy on 1 April of the current year for $2400. A 3-year policy was purchased on 1 October of the previous year for $4500. Both purchases were recorded by debiting Prepaid Insurance.

5. The business has two part-time employees who each earn $300 a day. They both worked the last 2 days in June for which they have not yet been paid.

6. On 1 June, the Highup Hotel paid the business $2100 in advance for doing their ironing for the next 3 months. This was recorded by a credit to Ironing Revenue.

7. Water for April to June of $320 is unpaid and unrecorded.

8. The supplies account had a $120 debit balance on 1 July. Supplies of $1410 were purchased during the year and $180 of supplies are on hand as at 30 June.

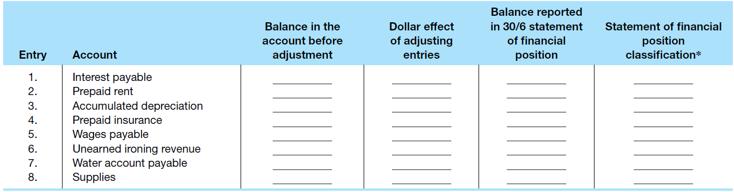

As you know, all adjusting entries affect one statement of financial position account and one income statement account. Based on your adjusting entries prepared:

(a) complete the schedule given above

(b) calculate the increase or decrease in profit

(c) calculate the increase or decrease in total assets, total liabilities and total equity.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie