Oakfield Operations Ltd, which has been trading profitably for many years, is planning to expand the business

Question:

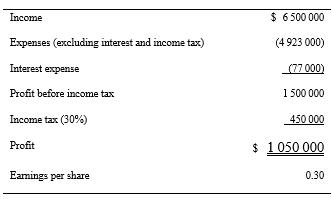

Oakfield Operations Ltd, which has been trading profitably for many years, is planning to expand the business to meet the increasing demand for its services. The issue price of all shares is \($1.25\). It plans to invest \($4\) 000 000 to finance this expansion, and as a result achieve an increase in profit before interest on debt and income tax of \($800\) 000. A summary of financial results for the financial year ended 30 June 2024 is presented below.

Management is considering whether to finance the expansion by selling 3 200 000 shares at \($1.25\) per share or by issuing 8% 10‐year debentures at a nominal value of \($100\) each.

Required

(a) Assuming that the company achieves the expected increase in profit from the expansion, what will be the earnings per share for each of the alternative methods of financing proposed?

(b) Discuss the disadvantage(s) of the method that produces the highest earnings per share.

(c) What other factors might be considered by management in making its decision on the preferred financing method?

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie