On 21 November, the weekly payroll register of Parade Events Ltd showed gross wages and salaries of

Question:

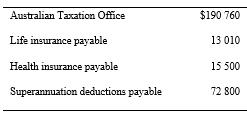

On 21 November, the weekly payroll register of Parade Events Ltd showed gross wages and salaries of \($374\) 000. The organisation withheld \($89\) 760 for income tax, \($6\) 680 for life insurance, \($10\) 000 for medical insurance premiums, and \($37\) 400 for superannuation deductions made on behalf of employees. Prior to this transaction the entity’s current liabilities (extract) were as follows.

Required

(a) Prepare the general journal entry to record the payroll and payroll deductions.

(b) Prepare the general journal entry to record the employer’s contributions to the employees’ superannuation fund at the rate of 15% of gross payroll.

(c) Prepare entries in the cash payments journal to record payment of the above liabilities.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie