Over a 5-year period, Eureka Ltd completed the following transactions affecting non-current assets in financial years ending

Question:

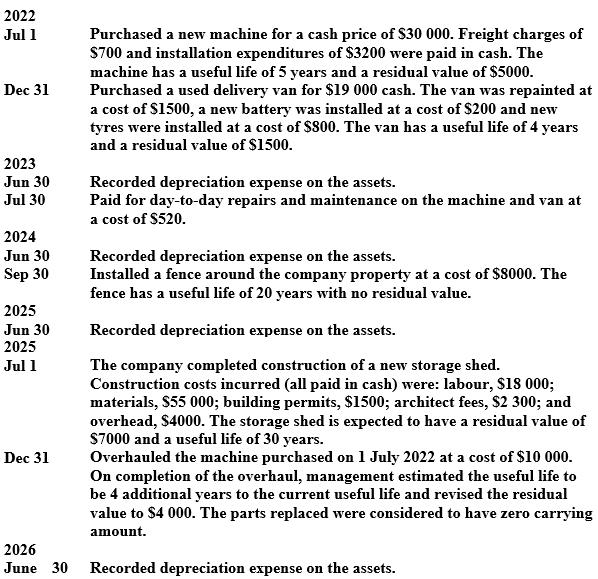

Over a 5-year period, Eureka Ltd completed the following transactions affecting non-current assets in financial years ending 30 June. The company uses straight-line depreciation on all depreciable assets and records depreciation to the nearest month. Ignore GST.

Required:

(a) Prepare journal entries to record all the transaction of Eureka Ltd.

(b) Prepare a schedule showing the cost and accumulated depreciation of each asset after recording depreciation on 30 June 2026.

(c) Post the journal entries in requirement A to the appropriate non-current asset accounts from 1 July 2022 to 30 June 2026.

Transcribed Image Text:

2022 Jul 1 Dec 31 2023 Jun 30 Jul 30 2024 Jun 30 Sep 30 2025 Jun 30 2025 Jul 1 Dec 31 2026 Purchased a new machine for a cash price of $30 000. Freight charges of $700 and installation expenditures of $3200 were paid in cash. The machine has a useful life of 5 years and a residual value of $5000. Purchased a used delivery van for $19 000 cash. The van was repainted at a cost of $1500, a new battery was installed at a cost of $200 and new tyres were installed at a cost of $800. The van has a useful life of 4 years and a residual value of $1500. Recorded depreciation expense on the assets. Paid for day-to-day repairs and maintenance on the machine and van at a cost of $520. Recorded depreciation expense on the assets. Installed a fence around the company property at a cost of $8000. The fence has a useful life of 20 years with no residual value. Recorded depreciation expense on the assets. The company completed construction of a new storage shed. Construction costs incurred (all paid in cash) were: labour, $18 000; materials, $55 000; building permits, $1500; architect fees, $2 300; and overhead, $4000. The storage shed is expected to have a residual value of $7000 and a useful life of 30 years. Overhauled the machine purchased on 1 July 2022 at a cost of $10 000. On completion of the overhaul, management estimated the useful life to be 4 additional years to the current useful life and revised the residual value to $4 000. The parts replaced were considered to have zero carrying amount. June 30 Recorded depreciation expense on the assets.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie

Question Posted:

Students also viewed these Business questions

-

Marcy currently pays 15% in dividends and capital gains taxes and 25% in ordinary income taxes. She expects to retire in three years when her dividends and capital gains taxes will decline to 5% and...

-

Over a 5year period, Downton Ltd completed the following transactions affecting noncurrent assets in financial years ending 31 December. The company uses straightline depreciation on all depreciable...

-

Over a 5-year period, Downton Ltd completed the following transactions affecting non-current assets in financial years ending 31 December. The company uses straight-line depreciation on all...

-

A bartender employed in a licensed establishment over-serves a patron. As a result of the over-service, the patron physically assaults another patron by striking him with a beer bottle. Identify and...

-

Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the year. If her adjusted gross income (all from wages) for the...

-

There are now 143,781,202 registered passenger cars, and in 1980 there were 121,601,000. For each pair of values, use a percentage to express their relative change or difference. Use the second given...

-

The KOF Swiss Economic Institute prepares the annual KOF Index of Globalization, which ranks the most globalized countries (enter KOF Index of Globalization at globalEDGE or other search engine). The...

-

Cal Murphy is emigrating from Canada to take up residence in Jakarta, Indonesia. At the time of his departure, Cal will have the following Canadian assets: Cal has been impressed by the capital...

-

The bank statement and bank columns in the cash book of King Food Enterprise for the month of April 2021 are as follows: Credit RM 790 465 Date April 1 8 9 16 16 18 23 27 28 30 30 30 Bank Statement...

-

Pioneer Manufacturing Ltd completed the following transactions during 2023: Required Prepare journal entries to record all the transactions of Pioneer Manufacturing Ltd from 1 July 2023 to 30 June...

-

On 2 January 2024, Omega Ltd purchased, by exchanging \($420\) 000 cash and a \($250\) 000, 12%, 18-month finance company loan, assets with the following independently determined appraised values....

-

Describe the main differences between rigid and flexible couplings as they affect the stresses in the shafts that they connect.

-

Skinovations needs to put together a Production schedule for next week and has asked its marketing team to give its forecasts for next week's sales. The team has used two different forecasting...

-

If a potential leader viewed her least preferred co-worker in favorable terms, how would Fiedler's Model describes this leader?

-

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company s financial statements,...

-

For our first discussion you should locate a research article in which a quantitative study is reported. This article should not be a theoretical article or a methods article, but should describe...

-

A box is separated by a partition which divides its volume in the ration of 3:1. the larger portion of the box contains 1000 molecules of Ne gas; the smalled portion contains 100 molecules of He gas....

-

Suppose that an F-test (as described in this chapter using the p-value approach) has a p value of 0.04. a. What is the interpretation of p-value = 0.04 ? b. What is the interpretation of the...

-

How will relating product contribution margin s to the amount of the constrained resource they consume help a company maximize its profits?

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App