PKE Ltd commenced coachiness on 1 July 2023. Property was purchased to construct a manufacturing plant for

Question:

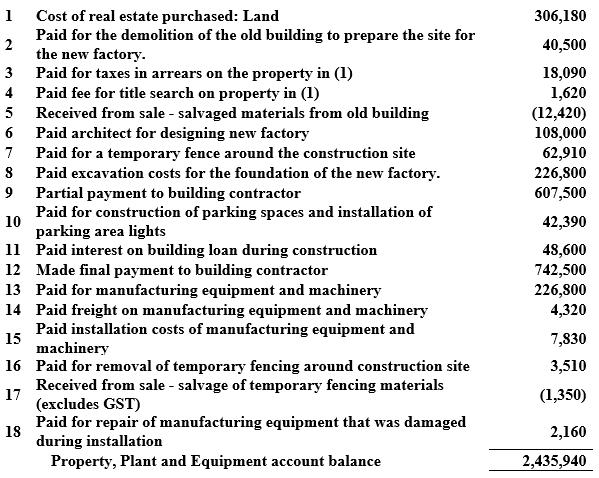

PKE Ltd commenced coachiness on 1 July 2023. Property was purchased to construct a manufacturing plant for operations. Once construction was completed, the plant opened and commenced on 1 February 2024. The trainee accountant, unsure how to classify the various transactions for the property, plant and equipment simply recorded all of the transactions in the one property, plant and equipment account. The list below summarises the expenditures and receipts involving this asset (Ignore GST):

Required

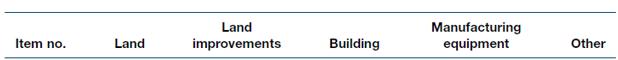

(a) To assist in the preparation of the notes to the financial statements for the property, plant and equipment, the accountant has asked you to analyse each of the above transactions and present them in a schedule totalling the columns using the template below. Ignore GST.

(b) Prepare a general journal entry to close the $2 435 940 balance in the Property, Plant and Equipment account and allocate the transactions to their appropriate accounts identified in the schedule prepared in (a).

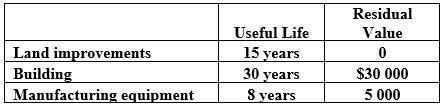

(c) Prepare an entry to record depreciation expense for the year ending 30 June 2024 on land improvements, building and manufacturing equipment using straight-line depreciation. Useful lives and residual values are presented below:

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie