Quick Smart Dry Cleaners Ltd uses the straight-line method for recording depreciation of its assets. The following

Question:

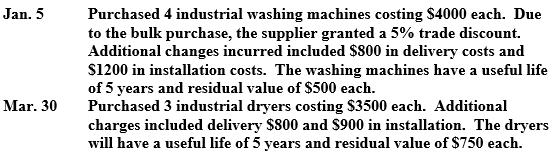

Quick Smart Dry Cleaners Ltd uses the straight-line method for recording depreciation of its assets. The following is a summary of the non-current assets purchased during the second half of the financial year ending 30 June 2023. Ignore GST

Required

(a) Prepare journal entries to record the purchase of the assets and to record depreciation expense on 30 June 2023 and 2024, the end of the company’s reporting periods.

(b) Prepare an Equipment account (No. 240) and an Accumulated Depreciation-Machinery account (No. 241), and prepare subsidiary property and equipment records for the two assets. Post the journal entries to the general ledger accounts and to the subsidiary property and plant records.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie