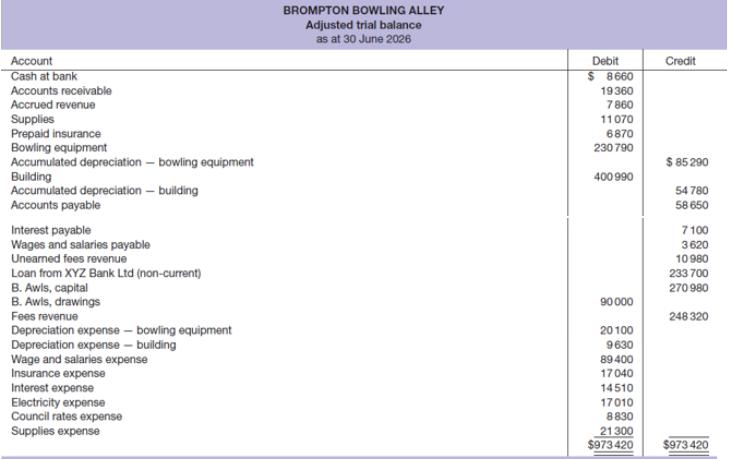

The adjusted trial balance of Brompton Bowling Alley at 30 June 2026, the end of the entitys

Question:

The adjusted trial balance of Brompton Bowling Alley at 30 June 2026, the end of the entity’s accounting year, follows.

Additional data taken into account in the preparation of the above adjusted trial balance at 30 June 2026.

1. Unearned fees revenue earned during the year, \($5540.

2.\) Prepaid insurance expired during the year, \($16\) 800.

3. Accrued interest expense, \($6100.

4.\) Supplies used during the year, \($8300.

5.\) Fees revenue earned but not recorded, \($7860.

6.\) Depreciation for the year: bowling equipment, \($20\) 100; building, \($9630.

7.\) Accrued wages and salaries expense, \($3620.

Required

(a) Prepare the income statement and statement of changes in equity for the year ended 30 June 2026 and a classified balance sheet as at 30 June 2026.

(b) Record adjusting and closing entries in the general journal.

(c) Prepare any suitable reversing entries on 1 July 2026.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie