Ali, Broc and Cheema have been in partnership trading as Abche They share profits and losses in

Question:

Ali, Broc and Cheema have been in partnership trading as Abche They share profits and losses in the ratio 3:2:1. Gavin and Hanuko have been in partnership trading as Gavu. They share profits and losses equally.

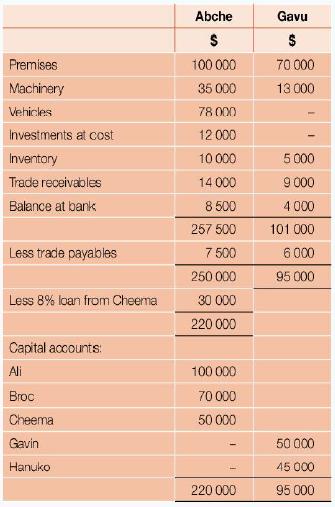

At 31 March 2015 the summarised statement of financial position of both businesses was as follows.

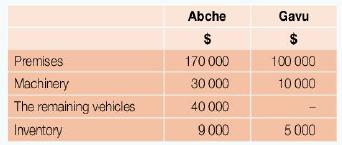

The partners agreed to form a limited company, ABCOGH Ltd, to take over both businesses. All Abche's assets were transferred to ABCOGH Ltd with the exception of three vehides, investments, trade receivables and balance at bank. All Gavu's assets were transferred to ABCOGH with the exception of trade receivables and balance at bank. The agreed values of assets taken over by the company are:

The purchase consideration for Abche was $240,000 as fdlows:

• 57,000 7 per cent preference shares of $1 each to be distributed in profit-sharing ratios

• Sufficient 6 per cent debenture stock to give Cheema the same return as he had received on his loan to the partnership

• The balance as ordinary shares of $1 at a premium of $0.30 per share distributed to the partners in proportion to their capital account balances at 31 March 2015.

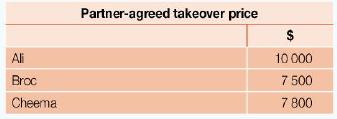

Abche collected $12,900 cash from trade receivables. Trade payables accepted 37100 in full settlement of amounts due to them. The three vehicles that have been used by the partners were taken over by them as follows.

The investments at cost were purchased by Broc at an agreed value of $13,400. The purchase consideration for Gavu was $134 000 as follows:

• 43,000,7 per cent preference shares of $1 each to be distributed equally.

• The balance as ordinary shares to be shared equally.

Costs involved in dissolving the Abche partnership amounted to $6400; costs to dissolve the Gavu partnership were $3100. Gavu cdlected $7000 cash from trade receivables. Trade payables were paid the amounts due to them.

Required

a. Prepare partnership capital accounts at 31 March 2015 for both businesses to show the closing entries in both sets of partnership books of account.

It was agreed that the issued ordinary share capital would be held as follows: Ali 30 per cent; Broc 10 per cent; Cheema 20 per cent; Gavin 20 per cent; Hanuko 20 per cent. It was further agreed that the transfer price of any ordinary shares would be at $1.30 per share.

Required

b. Calculate the number of ordinary shares received by each partner.

c. Calculate the amounts of cash payable or receivable by each shareholder to achieve the required shareholding.

d. Prepare a statement of financial position for ABCOGH Ltd at 31 March 2015 immediately after incorporation.

e. Explain briefly one possible reason why the partners decided to change their business into a limited company.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone