One of the assembly machines at Roberts Ltd needs to be replaced. A replacement machine will cost

Question:

One of the assembly machines at Roberts Ltd needs to be replaced.

A replacement machine will cost $200 000, which is payable on purchase. The replacement machine is expected to last four years, and will be depreciated using the straight-line method. It will need a complete maintenance check-up in year 3 at a cost of $50 000.

The existing machine assembles 4000 units a year. The number of units assembled by the replacement machine in year 1 is expected to be 35 per cent lower than the existing machine due to the time lost during installation and testing. In year 2 it is expected that 4500 units will be assembled, and this will increase by 20 per cent each year compared to the previous year.

The existing machine produces units at a cost of $26 each whereas the replacement machine will produce units at a cost of $24 each. The selling price is currently $42 per unit, but with the improved quality provided by the replacement machine this will increase to $45 per unit. From year 3 it is expected that the cost of manufacture will increase by 25 per cent each year and the selling price will increase by 30 per cent each year compared to the previous year.

The cost of capital is 14 percent.

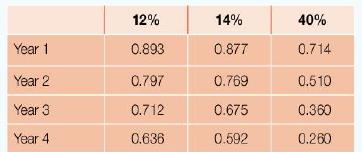

The following is an extract from the present value tables for $1.

It is assumed that all production is sold,

a. Calculate the expected net cash flows for each year for the replacement machine.

b. Calculate both the payback period and discounted payback period for the replacement machine.

c. Calculate the ARR for the replacement machine.

d. Calculate the NPV for the replacement machine using the expected net cash flows. Assume that revenues are received and costs are paid at the end of each year.

e. By selecting a relevant discount factor, so that you have both a positive and a negative NPV, calculate the internal rate of return. Use the 12 per cent and 40 per cent columns in the table provided.

f. Should the managers of Roberts Ltd purchase the new machine? Give reasons for your choice.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone