The directors of Esplan Ltd have agreed to take over the business owned by Rakesh on 1.

Question:

The directors of Esplan Ltd have agreed to take over the business owned by Rakesh on 1. March 2015. Rakesh plans to retire. Both businesses operate as retailers of electrical goods.

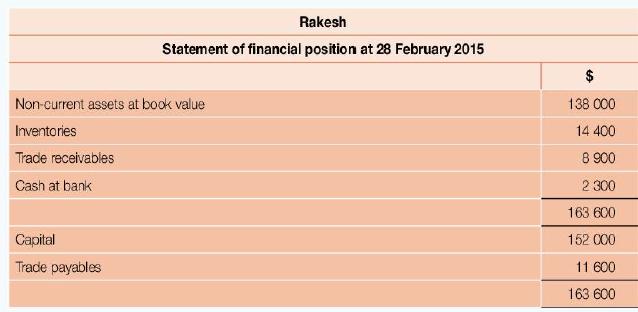

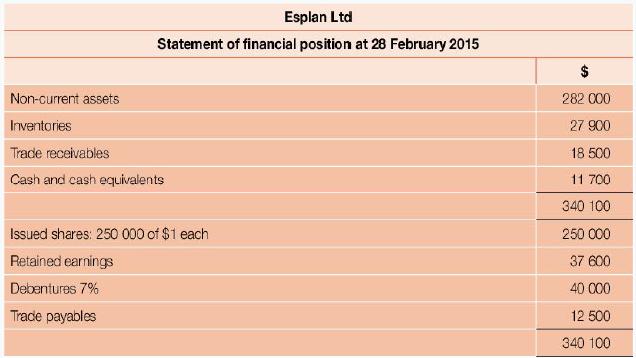

The summarised statements of financial position of both businesses on 28 February 2015, immediately before the acquisition, are shown below.

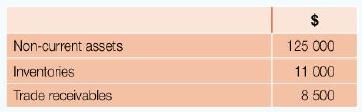

It was agreed that the company would take over all the assets and liabilities except the bank balance. The assets taken over were revalued as follows.

The purchase consideration of $180,000 was to be settled as follows:

• The issue of 90,000 ordinary shares of $1 each

• The issue of 7 per cent debentures, $30,000

• A cash payment of $15,000.

All transactions relating to the takeover were completed on 1 March 2015.

a. State four potential benefits of the company taking over the business owned by Rakesh.

b. Calculate the profit made by Rakesh on the takeover of his business by Esplan Ltd.

c. Prepare a summarised statement of financial position of Esplan Ltd on 1 March 2015 immediately after the takeover of Rakesh's business had taken place.

In recent years Rakesh had achieved a return on capital employed of 12 per cent per annum. He hopes to be able to invest all the cash available after the takeover in an investment earning interest of 5 per cent per annum. Rakesh is aware that Esplan Ltd has maintained a dividend of policy of $0.20 per share for the last few years. Rakesh believes he will be better off financially after the takeover.

d. Do you agree that Rakesh will be better off financially after the takeover? Provide detailed financial information to support your answer

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone